Philadelphia Then and Now: Disparities in Mortgage Lending

Mortgages are the financial cornerstone that allows most American families to purchase their homes. However, some families face more difficulties than others when applying for a mortgage. Could applicants’ race and ethnicity impact on these lending decision disparities?

In 2017, Reveal, the investigative journalism, published findings showing that in the Philadelphia metro, based on the Home Mortgage Disclosure Act (HMDA) data for 2016, Black and Hispanic applicants were 2.7 and 1.8 times, respectively, more likely to be denied conventional loans than Non-Hispanic White applicants. These results controlled for credit and census tract variables available in the HMDA filings. However, critical credit variables not available in HMDA data such as FICO credit score or other internally developed ones were not included in their analysis. This paper assesses the impact of missing confounders like FICO in the Reveal analysis for the 2016 HMDA data and provides the trend of the disparities from 2017 to 2022. Performing sensitivity analysis to determine if a missing confounders can explain away the race/ethnicity effect is a novel approach that has never been addressed within the Fair Lending academic.

Reveal’s story focused on the uneven access to the conventional mortgage market for applicants of color compared with White applicants. In particular, Reveal focused on Philadelphia because the race/ethnicity consistently proved to be statistically significant regardless of which variables were included. Reveal obtained publicly available HMDA data. In addition, Reveal looked at every variable in the HMDA data set and added additional ones based on the feedback from experts and research. However, critical credit variables such as FICO scores were not available and were not included in the Reveal study. Several studies stated that FICO scores are correlated with race. Omitting such an important unmeasured confounder may bias the estimation of the true causal effect; thus, leading to wrong conclusions. Therefore, it is reasonable to ask if the results of Reveal are biased due to this omission: Is an unmeasured confounder such as FICO score strong enough to explain away the estimated race effect? The response to this question involves sensitivity analysis to unmeasured confounders. VanderWeele and Ding provided a minimal threshold of the risk ratio between the exposure (e.g., being Black) and the outcome (e.g., being denied a loan) for an unmeasured confounder to explain away the exposure effect (e.g., FICO score) on the output. This threshold is termed E-value, which is defined as the minimum strength of association on the risk ratio scale that an unmeasured confounder would need to have with both the treatment and the outcome to fully explain away a specific treatment-outcome association, conditional on the measured covariates.

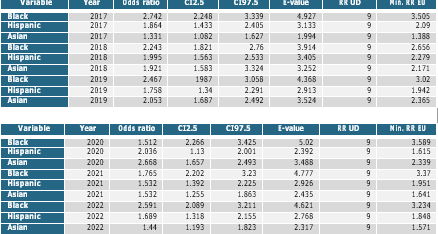

In this paper, a logistic regression was fitted with the 2016 HMDA data. The E-value was derived to express the exposure- confounder (RR EU) and the confounder-outcome association (RR UD) needed to explain away the race effect on the denial probability. The same analysis was performed from 2017 to 2022.

In addition, this paper includes a popular disparity metric, the marginal effect, which provides the difference between the average probability of denials between minorities and White applicants after adjusting for the measured covariates.

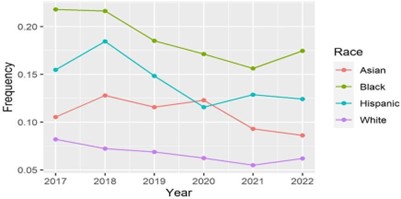

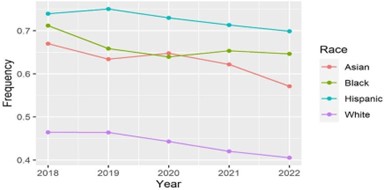

Figure 1 and Figure 2 provide the trend of the rate of denials for conventional loans and refinancing by race. Both refinancing and conventional loans denial rates have been trending down since 2017 for all minorities and non-minorities.

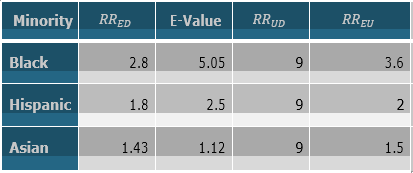

As described above, Reveal fitted a logistic regression to the Philadelphia metro using HMDA data where the output or dependent variable is the binary decision, the exposure variables are minorities race, and the reference race is White. The results show that the odds of being denied a conventional loan in the Philadelphia MSA for Black applicants were 2.77- times higher than those of the White applicants. They were 1.78 times higher for Hispanic applicants and 1.41 times higher for Asian applicants.

Reveal analysis did not include applicants credit scores because they are not available in the HMDA data. Generally, White, and Asian applicants have, on average, higher FICO credit scores. Omitting such an important confounder may bias the results of the Reveal’s regression and may lead to wrong conclusions.

The E-value is a measure related to the “evidence for causality†in observational studies when they are potentially subject to confounding. The E-value is defined as the minimum strength of association on the risk ratio scale, which unmeasured confounders would need to have with both the treatment and the outcome to fully explain away a specific treatment-outcome association, conditional on the measured covariates.

As an example, in this paper, we assumed that the relative risk of FICO score below 683 (where denials are more likely to occur) on the outcome was 9 , which means applicants with FICO score below 683 are 9 times more likely to be denied the loan than those with FICO score above 683. In this scenario, we derive the relative risk of FICO on the exposure, for each minority (RR EU) necessary to explain away the effect of minority race on the denial decision.

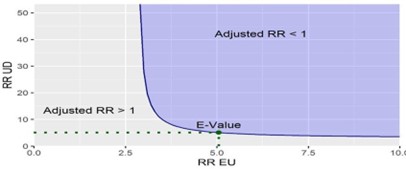

The following figure shows the confounder strength frontier for different values of relative risk of the confounder on the outcome (RR UD) and the confounder on the exposure (RR EU). The intersection of the horizontal dashed line with the curve is the E-value. All the combinations of RR UD and RR EU that lie within the frontier and the purple region are the ones that allow to explain away the race effect on denials.

In addition, this study shows, from 2017 to 2022, the odds ratios, their 95% confidence bounds, the E-value, and the minimal value of RR EU when RR UD =9, that is required for the unmeasured confounder to neutralize the racial disparity of the conventional mortgage lending decision.

Metro Disparity Analysis Over the Years

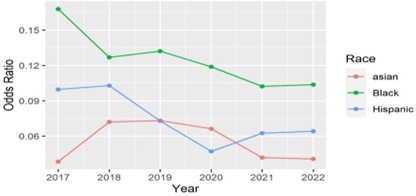

Regarding the marginal effects, the following figure shows the trends.

As regards Black applicants, the marginal effect was 17% in 2017 and 11% in 2022. In other words, everything being equal, the probability of being denied a conventional loan in the Philadelphia metro for Black applicants was 17% higher than for White applicants in 2017 and 11% higher in 2022.

To summarize, in general, the lending disparities between minorities and White applicants in the Philadelphia metro have been trending downward. However, for African American applicants, they are still at a significantly higher level than for similarly situated White applicants and the sensitivity analysis seems to indicate that a very strong unmeasured confounder is needed in order to explain away this disparity.

Authors: Maia Berkane, Diego Alvarez, and Nicolas Tanzi